Beer was a better investment than shares in March 2000

At the height of the stock market bubble in March 2000, you would have been better off financially if you bought beer for all your cash and recycled the cans, than if you "invested" the money in IT shares. As it were, the entire Nasdaq index (not only tech stocks) declined by 80 percent between March 2000 and October 2002 and many stocks declined by much more. Just cash would of course have been so much better, or bonds or gold.

Remember that the difference between falling by 80% and 90% respectively, is an additional fall by 50% in value.

And yet another 50% loss takes the total loss to 95%. A third sequential 50% loss after the initial 80% plunge renders a total loss of 97.5%. Many IT and new media stocks declined by 95-99% when the Nasdaq bubble burst - and a relevant proportion even went bankrupt.

The IT crash was no surprise

To many thoughtful and experienced investors the crash didn't come as a surprise, since the warranted values and fundamentals simply didn't rhyme with stock market valuations. But how could you have known this? And what can you know about today's stock market valuations? I mean, you really can't tell the future, can you? No, you can't, but you can look at today's valuations, just as you could in the year 2000 and year 2007.

Amazon - buy the merchandise not the shares

Let's take a closer look at Amazon's shares. A quick visit to Market Watch tells you the stock price is 305 USD/share and the total market capitalization is 141 bn USD, but there is no information about valuation (since they operate at a loss and don't distribute dividends). And there definitely isn't any information about what your return or profit/loss from an investment will be. So, what do you do, ask your friendly neighbourhood spider? No, you do it yourself.

Are you an astute investor or an ignorant speculator

This is what you should do to form your own opinion about whether to purchase Amazon shares or not; decide what kind of an investor you are:

- Active or Passive. A passive investor just buys and holds single stocks or indices and never sells. An active investor buys and sells at various intervals, depending on a multitude of factors (we'll get to that later)

- Single stocks or Indices. If you chose index-only investing, forget about Amazon (duh!)

- Fundamental or Technical. Are you willing to make an effort to understand what you invest in, do the math so to speak, or are you more inclined to speculate on tips, momentum, stock charts etc?

- Hope or Safety. Will you trade on hype and hope, on blue sky scenarios, or do you have the discipline and patience to wait for opportunities that offer a margin of safety

If you decide you are an Active investor and Single stocks focused you can proceed. If you are Passive, just buy the stocks or an index already and go back to sleep.

If you just can't be bothered with math, spread sheets, forecasts and economics, do what so many others do: draw pretty pictures in stock charts and invest according to the patterns you think you can discern. Or just follow whatever momentum or trend you see or are told about by a "friend" or broker. Just don't blame me when you are broke.

Your broker is your adversary

Stock brokers don't want you to make good investments or be your friend. They want you to pay a commission. When you buy, somebody else sells. One of you is making a mistake. And the broker couldn't care less.

Charlatans (stock brokers and company representatives) use extremely simple and misleading measures of valuation such as some future year's Price/Earnings ratio (given made-up profit margins), perhaps complementing it with an arbitrary, historical growth number:

"Amazon has increased its number of employees by 36 per cent in the last 4 quarters and at normalized operating margins of 10% it's trading at a P/E ratio of just 18 (earnings in 2016), i.e. only half (!) its Growth rate! PEG=0.5"

The above may sound pretty convincing. But if you look more closely you'll see the cracks in the facade:

- Okay, so the number of employees is growing by 36%, but sales are only growing by 20% year over year in 2014, and slowing. A better forecast of sales growth in 2016 is 15%, given current trends. And what an investor really wants to know is the growth rate thereafter (which probably is even less). Actually, unless profitability accelerates soon, Amazon needs to taper its hiring pace, which will hurt sales growth as well. Nevertheless, let's give them the benefit of the doubt for now. We can refine the model later.

- Normalized profit margins? Why would they be 10% when actual margins are between 0-1%? Are there any plausible reasons to forecast higher margins than what Amazon has produced the last 5 years? Actually, there might be, if they reach scale, when growth diminishes, margins could increase. Look to similar companies for guidance on potantial margins. Also make a sanity check on what those margins will mean for Amazon's Return On Equity. Few companies stray outside 5-20% for long. Either they draw in competitors or they go out of business. Assuming Amazon can increase its margin to 1.5% they will make a decent 15% ROE. Hoping for more is just that; hoping and believing the hype.

- P/E-ratio of 18 in 2016... Why is that supposed to be cheap in an absolute way? To start with it should be compared to profit or cash flow growth which can be approximated by sales growth - in our example at most 15% (probably less after 2016). Suddenly the PEG is >1.2 instead of 0.5. That still doesn't say anything about whether it's a good buy or not, but it's apparently a lot more expensive than what the broker first said. And, I almost forgot, that was based on a 10% profit margin. Assuming 1.5% instead, renders a P/E of 117 and a PEG of 8. That is 16x expensive-er than the broker was saying. In addition, whatever happens in 2016 is less worth than if it was today so profits should be discounted by your required rate of return. A P/E of 117 two years hence is more equivalent to a P/E of 117*1.1^2 = 142 today. But, still, is it expensive?

- Continuing to use the extreme simplifications above, you can calculate earnings yields or dividend yields to see what your actual return would be a single year. If you dare extrapolate that year indefinitely, you can even rely on it as the stock yield. In Amazon's case, given 1.5% profit margin in 2016 the net profit is 1.2 bn and its earnings yield is (profit/market cap) 1.2/141 = 0.9%. If you are lucky all this profit generation is converted to cash and distributed to you in some way. Also, if you are lucky, 2016 is representative of the coming eternity for Amazon's business (in practice only about 50 years count).

There you have it. Given a set of simplifications, you can expect around 1% yield on an investment in Amazon. It doesn't really say anything about what price you'll be able to sell the stock for in the future, but if you just hold on to it forever, you'll get 1% annual return unless Amazon's business changes radically.

Happy? I'm not. And that's not because of the low return, it's because of all the simplifications.

Also note, that if in the future, when you want or need to sell the stock to get your capital back, another valuation paradigm dominates, perhaps demanding the historical 6% or 10% or even 15% return on equity investments, the Amazon stock price will be proportionally lower. At a 9% required return, Amazon's stock price would be just a tenth of what it is at 0.9% required return.

That was the quick and dirty way of analysing and valuing single stocks. If you felt that was already too much, you are not an active or fundamental investor.

Either you do the forecasts or they do you

Make company forecasts

[PIC of my micro and macro variables]

The disturbing truth about how markets really work

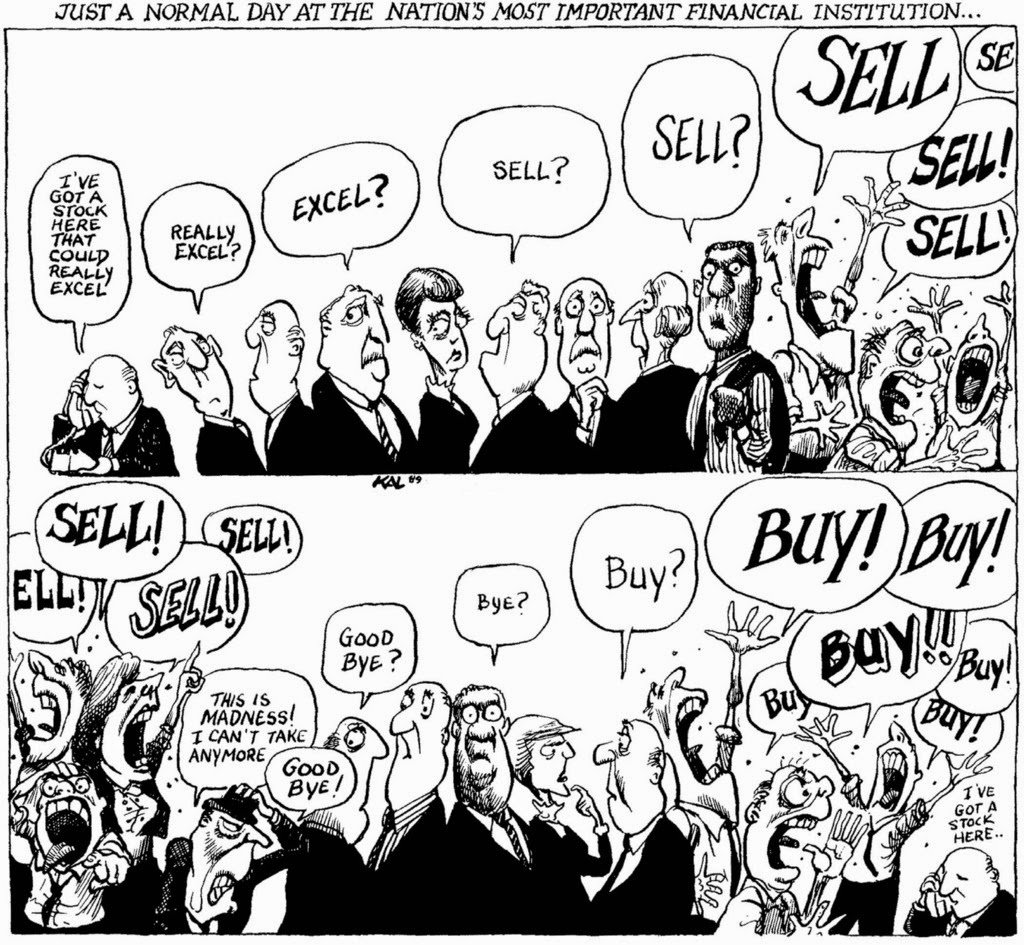

Stock prices and stock markets very seldom reflect the true long term value. Just as a stopped clock shows the right time twice a day, the stock market is valued correctly about every six years or so. This is good. It's something you can profit from; if you have the guts to take a contrarian view when everybody else is screaming sell or buy.

Markets are not weighing machines, they are beauty contests. They don't find the correct value of a stock and stay there. Markets create trends where the (perceived) prettiest stock is bought and the ugliest sold, until something, anything changes and the trend reverses. This makes stock prices and markets oscillate around the true value. In the process it creates twin opportunities for you as an investor: follow the momentum as well as buy low, sell high. I think you should try to do it all.

Don't mistake Hype and Hope for a strategy

Don't rely on blue sky scenarios. Very few companies hit it big. Why would yours? Inoculate yourself against rosy forecasts by checking old stock market tables and company histories. Where just a handful succeeded, hundreds fell into oblivion or exhibited mediocre numbers.

In the end it all is unbelievably complicated, despite there being just two possibilities any given time: Up or Down? There are thousands of professional investors, if not millions, trying to make money on the market, using different strategies. There are scores of companies competing for the same client wallet share. Remember that company management often get their forecasts completely wrong so how could you beat them at their own game?

Don't just flip a coin and hope for the best. Do the only thing very few investors do. Pay attention to long term fundamentals, be patient and only buy when you have a decent safety margin in terms of returns and think you can hold on forever and be pleased with that.

Don't hope to sell the stock to a bigger fool. Don't hope for efficient markets having priced all shares correctly so you can just wander in and buy blindly. Don't hope that any stock will work as a hedge against inflation and money printing.

Hope is not a strategy.

That was the quick and dirty way of analysing and valuing single stocks. If you felt that was already too much, you are not an active or fundamental investor.

Either you do the forecasts or they do you

Make company forecasts

- Make reasonably detailed P&L, BS and CF forecasts

- To do that you need to forecast sales, costs, wages, investments, loans, interests, taxes, dividends, buybacks etc

- To do that you need a view on demand, competition, currency (FX) movements, technological development etc.

- You also need the company's history to have any inkling of how its products have been received by the market and how management has been able to juggle all variables historically.

In addition to this fundamental single stock valuation, you should add a handful of supportive layers:

- Total market valuation (if it's cheap you stand a better chance the entire market will rise and help your shares appreciate)

- Momentum in the stock or the market (positive trends can lift all boats)

- Your willingness to gamble (and willingness to lose)

Stock prices move in cycles. Sometimes a certain industry or company is in vogue and sometimes it's simply not. You can try to speculate blindly with this momentum or you can choose to invest whenever the price is below a certain maximum threshold and sell when it is too high for a comfortable plausible return

Analysts make meteorologists look good

There is no secret to forecasting. No one can do it anyway and stock market pundits and economist are among the worst forecasters of all. I think my complete immersion in finance for a quarter century is why I have always marvelled at the accuracy of weather forecasting.

Collect historic data

Analysts make meteorologists look good

There is no secret to forecasting. No one can do it anyway and stock market pundits and economist are among the worst forecasters of all. I think my complete immersion in finance for a quarter century is why I have always marvelled at the accuracy of weather forecasting.

Collect historic data

- Get five-ten years of history for a simple set of books: sales, cost of goods, cost of personnel, cost of loans, taxes

- Make a rudimentary balance sheet: real L-T assets, goodwill and intangibles, S-T assets ex cash, cash, net working capital, equity, real equity

- Cash flows: operating profit after tax, investments, changes in NWC

- Double check for funnies: too low wages, personnel option compensation, share count; profit, cash flow and equity not adding up

- Check the latest quarterly trends more carefully: DSOs (accounts receivable/sales) e.g., how easy is it to get paid, overselling?

Make forecasts

- Find leading data series in daily, weekly, monthly or quarterly data: competitors, weather, monthly national data, PMI surveys, industrial output, retail sales FX, etc

- Start forecasting: Basically extrapolate trends in historical company numbers and leading data series. Allow for cyclicalities and reversions to the mean. E.g. profit margins and ROCE numbers tend to gravitate to a mean for the industry or the economy. Do not expect super profitability or super growth for eternity. Check how long the very best companies of all time sustained their growth, margins or returns. Check what the average company did, including those that failed and are no longer here. Easiest is to check nation wide numbers for margin and growth trends.

- Check really long cycles and trends to make sure you don't get myopic, narrow sighted, seeing only one half of a cycle and thinking that is a long term trend

[PIC of my micro and macro variables]

All of this is particularly difficult for new companies and even more difficult if they operate in new industries. There is no history, no precedent.

Sell side analysts take advantage of that, and general optimism, to forecast blue sky scenarios only, luring in buyers. Rising share prices then act as evidence the forecasts are correct.

Sell side analysts take advantage of that, and general optimism, to forecast blue sky scenarios only, luring in buyers. Rising share prices then act as evidence the forecasts are correct.

Typically new companies are valued using new (i.e. unproven) key indicators; like clicks or eye balls or users, no matter if the latter are paying customers or not. Some even use costs as a key indicator when there are no sales. The more costs, the more losses, the higher the value... Biotech analysts have been trail blazers within cost valuation.

Don't forget geographical trends, product trends... to see if, e.g., the first markets, the home markets are losing steam, or perhaps if new markets are small but growing quickly - which might not be visible in overall numbers otherwise.

Typically it takes at least a few years to get reasonably good at doing fundamental research, and at least a week to build a basic valuation model for a single company. It's hard work and it's complicated but it's worth it if you have a nest egg worth a handful of years' wages to invest.

Typically it takes at least a few years to get reasonably good at doing fundamental research, and at least a week to build a basic valuation model for a single company. It's hard work and it's complicated but it's worth it if you have a nest egg worth a handful of years' wages to invest.

The disturbing truth about how markets really work

Stock prices and stock markets very seldom reflect the true long term value. Just as a stopped clock shows the right time twice a day, the stock market is valued correctly about every six years or so. This is good. It's something you can profit from; if you have the guts to take a contrarian view when everybody else is screaming sell or buy.

Markets are not weighing machines, they are beauty contests. They don't find the correct value of a stock and stay there. Markets create trends where the (perceived) prettiest stock is bought and the ugliest sold, until something, anything changes and the trend reverses. This makes stock prices and markets oscillate around the true value. In the process it creates twin opportunities for you as an investor: follow the momentum as well as buy low, sell high. I think you should try to do it all.

- Buy whenever it is reasonably valued or cheap

- Sell if it is extremely expensive

- Ride the momentum until it seems to stop or valuations venture far out in the 5% tails

Don't mistake Hype and Hope for a strategy

Don't rely on blue sky scenarios. Very few companies hit it big. Why would yours? Inoculate yourself against rosy forecasts by checking old stock market tables and company histories. Where just a handful succeeded, hundreds fell into oblivion or exhibited mediocre numbers.

In the end it all is unbelievably complicated, despite there being just two possibilities any given time: Up or Down? There are thousands of professional investors, if not millions, trying to make money on the market, using different strategies. There are scores of companies competing for the same client wallet share. Remember that company management often get their forecasts completely wrong so how could you beat them at their own game?

Don't just flip a coin and hope for the best. Do the only thing very few investors do. Pay attention to long term fundamentals, be patient and only buy when you have a decent safety margin in terms of returns and think you can hold on forever and be pleased with that.

Don't hope to sell the stock to a bigger fool. Don't hope for efficient markets having priced all shares correctly so you can just wander in and buy blindly. Don't hope that any stock will work as a hedge against inflation and money printing.

Hope is not a strategy.

Summary

Don't read this if you own Amazon shares

My best guess is that Amazon's sales growth will fall slightly each year from 20% to 18%, to 15% to 10% to 8% to 5%. Then I would add a truly super year with outsized margins (10% instead of 1.5%) and 50% growth just to see what happens. I want to see what the market is discounting and if it is at all probable.

Even in that super year of 2020, the P/E in 2020 would be 10x. Discounted to today that wold be 18x for a stock that has gone ex growth (4-5% per year in 2021). Considering interest rates near zero, that might actually be an okay valuation - but then you must assume interest rates will stay low at least until 2020.

Just spending a few hours with Amazon's numbers, I think it is 10x as expensive as it should be. The current growth rate is only 20% per year, despite expanding its staff by 36%, and the company isn't making any profit. Assuming a decent 15% ROE in the future implies 1.5% operating margins and just 0.9% earnings yield (profit/market value).

I would require at least 10x that return to bet on Amazon succeeding in its endeavor to sell everything to everybody. Consequently, the stock price needs to fall by 90% to satisfy my return requirements.

In addition, I can't see any reason to assume growth or margins expand meaningfully in the future. Rather, I am worried growth will taper faster than most expect and that margins might fall to zero or below. As a sanity check, the 2019 P/E ratio would be 150. Discounted to 2014 that would be around 240. I might stomach 24 in the short term, but only because the market is extremely bullish and it's difficult to see an end to the money printing madness.

In my opinion the blue sky scenario is Amazon trading down by 90%. The base-line and worst case scenarios are that Amazon falls even more and becomes completely irrelevant and taken off the market.

So, what should you do? Well, not buy Amazon, that's for sure, but there are tens of thousands of other listed companies worldwide. And if they are all too expensive, just wait. I'm sure you will get a good opportunity within the coming ten years, and IMO, most likely within three. If that seems too long to you, you just aren't fundamental enough. Go play with the chartists instead.

The simple reason?: margins. Amazon's margins are too low and they are not rising. In addition there is no basis for expecting them to rise either, since Amazon's ROE is fully up to par when margins are at 1.5%.

- Decide what kind of an investor you are. Active? Fundamental? Single stocks and/or indices? Technical overlay?

- Do the math properly if you are going to do it at all. There is no big secret to forecasting; just do it, and be clear about your premises at all times. Make plausible and reasonable forecasts that are internally consistent. Double check your variables repeatedly. Believe the hype if you want; make a leap of faith in a product if you want, but make sure you understand that is what you are doing. Be explicit in your extreme assumptions.

- Is it cheap or not? Compared to what? To your required return? To your marginal borrowing costs (your most expensive loan if you have any), to what you think the market's marginal required return is or will be in the future? Compared to othe stocks?

- Decide on timing: It may be cheap, but markets are trending sharply downward. Don't buy until things calm down, or be prepared to ride a long downturn. Pace your purchases, buy a tenth at a time.

- Wait. Be patient. Don't expect opportunities just because you are looking right now. It may take years for real opportunities to arise, whether it is about stocks, finding a life partner or a dream job. It can take 20 years for fundamentals to manifest themselves. If you bought on the right side of cheap time will work for you. In the meanwhile you acumulate dividends and perhaps buy more shares.

Don't read this if you own Amazon shares

My best guess is that Amazon's sales growth will fall slightly each year from 20% to 18%, to 15% to 10% to 8% to 5%. Then I would add a truly super year with outsized margins (10% instead of 1.5%) and 50% growth just to see what happens. I want to see what the market is discounting and if it is at all probable.

Even in that super year of 2020, the P/E in 2020 would be 10x. Discounted to today that wold be 18x for a stock that has gone ex growth (4-5% per year in 2021). Considering interest rates near zero, that might actually be an okay valuation - but then you must assume interest rates will stay low at least until 2020.

Just spending a few hours with Amazon's numbers, I think it is 10x as expensive as it should be. The current growth rate is only 20% per year, despite expanding its staff by 36%, and the company isn't making any profit. Assuming a decent 15% ROE in the future implies 1.5% operating margins and just 0.9% earnings yield (profit/market value).

I would require at least 10x that return to bet on Amazon succeeding in its endeavor to sell everything to everybody. Consequently, the stock price needs to fall by 90% to satisfy my return requirements.

In addition, I can't see any reason to assume growth or margins expand meaningfully in the future. Rather, I am worried growth will taper faster than most expect and that margins might fall to zero or below. As a sanity check, the 2019 P/E ratio would be 150. Discounted to 2014 that would be around 240. I might stomach 24 in the short term, but only because the market is extremely bullish and it's difficult to see an end to the money printing madness.

In my opinion the blue sky scenario is Amazon trading down by 90%. The base-line and worst case scenarios are that Amazon falls even more and becomes completely irrelevant and taken off the market.

So, what should you do? Well, not buy Amazon, that's for sure, but there are tens of thousands of other listed companies worldwide. And if they are all too expensive, just wait. I'm sure you will get a good opportunity within the coming ten years, and IMO, most likely within three. If that seems too long to you, you just aren't fundamental enough. Go play with the chartists instead.

The simple reason?: margins. Amazon's margins are too low and they are not rising. In addition there is no basis for expecting them to rise either, since Amazon's ROE is fully up to par when margins are at 1.5%.

Which are your best investments right now?

What about Exxon, Wal Mart, MSFT, GE, Apple?

And can you come up with a really interesting investment idea that is cheap and not reliant on zero interest rates or a hockey stick forecast for its amazing and unique products?

You do the math and present your results in as brief a form as possible in the comment section. What's the key assumption (like margins were for Amazon)?

Do you want my view on the above stocks? SUBSCRIBE (button on upper right of the page)