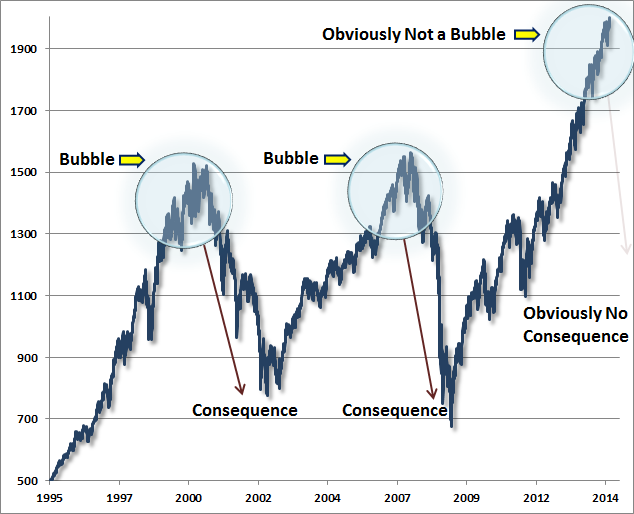

No bubble,... obviously

No timing for old men in corporate board rooms

Hickey offers some calming comments on gold, not least that September through February seasonally is the best time to own gold, due to Indian festival season, wedding season, Christmas and New Year. So far, the Indian government has disappointed regarding import restrictions but that positive possibility lieas ahead. The next big leg up, however, should occur when investors lose faith in Fed, due to a weak economy and or plunging stock market.

Most of all, Hickey spends time, and words, on describing how the peaks of 2000 and 2007 were his darkest periods, and how he and other "bears" were growing despondent and giving up on the short side. Hickey, however, managed to stay the course and didn't give up then - and he is not giving up now, either.

With just 13% bears left, NYSE margin debt at 460bn, desperate reach for yield in extremely risky bonds, a tripled stock market during the worst economic recovery in modern history, trillions of new dollas printed, extremely high valuation multiples (P/GDP, P/S, CAPE) and calls for the first trillion dollar market cap company (just as in 2000 for Intel and Cisco), Hickey sticks to his shorts (as do I).

Janjuah's "forecasts" in short are as follows (Buy the dip if there is one, then possibly sell stocks hard early in 2015 if VIX goes below 10):

Next 3 to 4 months: I would use any risk asset weakness over the balance of September and early October as an opportunity to BUY risk into year-end/early 2015. I don’t expect huge gains (5%, maybe up to 10%)

As I have said for at least a year now, until and unless we see a weekly close (ideally consecutive weekly closes) in the VIX index below 10, then I judge risk-on has more to go. We got close in June/early July, but we did not get there. I would expect that, if I am right about the next quarter or two, then VIX should hit this target during this timeframe. At that point, positioning for the big turn and reversal of large chunks of the nominal wealth/asset price gains since early 2009 would take over as my key investment strategy.